Contents

Introduction

With the launch and popularization of the Digital RMB (e-CNY), China’s payment system is undergoing a revolutionary transformation. On March 18, 2024, the People’s Bank of China released the Digital RMB User Guide, marking the latest initiative aimed at facilitating mobile payments for foreigners. For foreigners visiting China for the first time, mastering how to pay with the Digital RMB, also known as China e-CNY, is crucial for an uninterrupted travel experience. This guide provides you with the essential knowledge and steps needed to make payments with the Digital RMB or China e-CNY.

This is one of the most important pieces of digital currency information in the world. Since 2014, it has been 10 years, and China’s digital currency has finally gone global on March 18, 2024. That is, China has launched the overseas version of the Digital RMB APP, supporting more than 210 countries and regions. Below, we will provide all the details of the China e-CNY APP.

What is China Digital RMB (China e-CNY)

- Overview: The Digital RMB is a legal digital currency issued by the People’s Bank of China, intended to replace some of the circulating paper and coin currency.

- Features: Equivalent to traditional RMB, maintains anonymity, and supports online and offline payments.

Below is the detailed information on China e-CNY (Digital RMB) for Foreigners Coming to China:

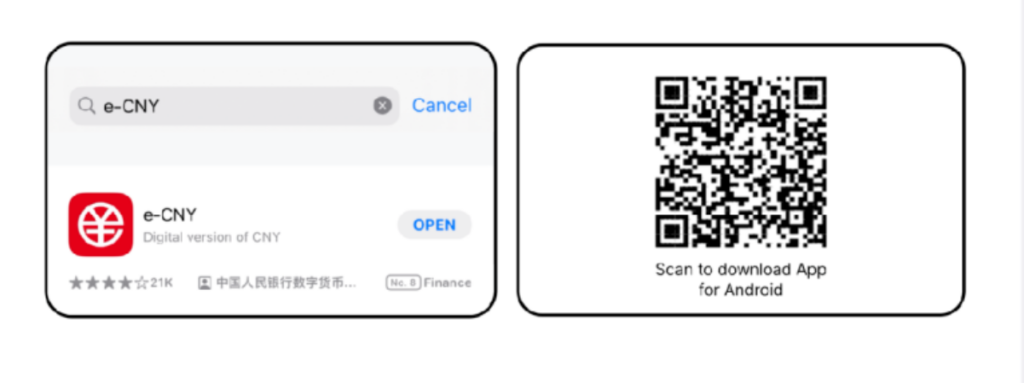

Please search for the keyword ‘e-CNY’ on the APP Store of Google Play and Apple Store to Download and install the e-CNY APP. Android can also scan the OR Code Below directly.

China e-CNY: Open an e-CNY Wallet

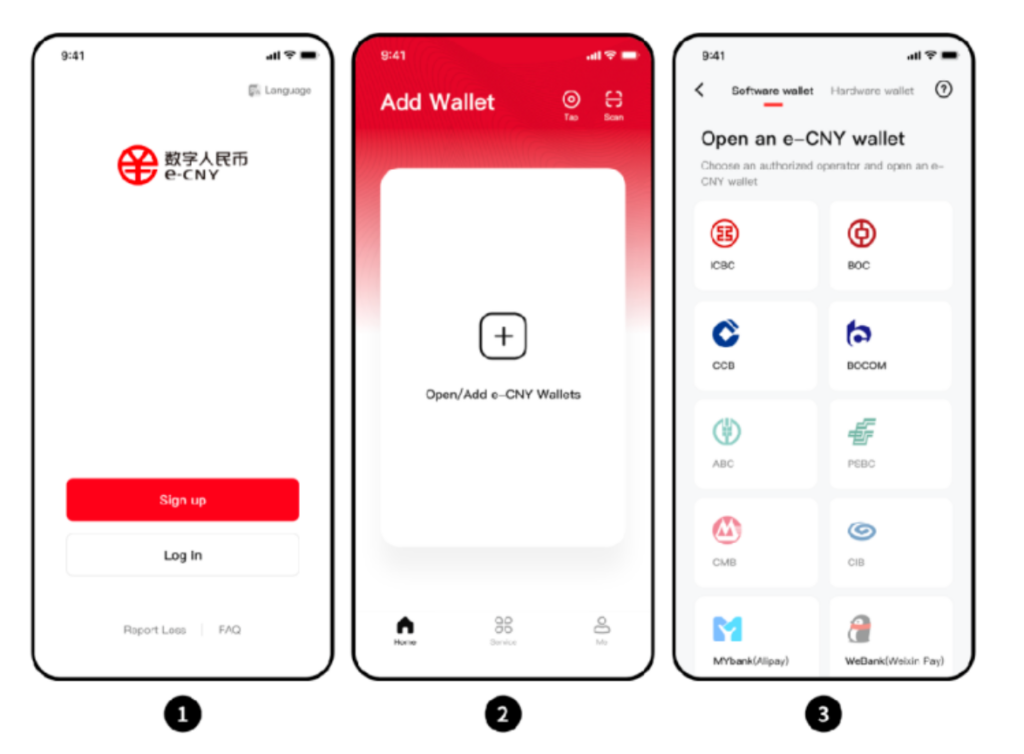

* Open e-CNY APP and tap ‘Sign Up’ to register.

* Tap ‘Open/Add e-CNY Wallets’ and Choose any authorized operator that supports international service as below to open your e-CNY wallet(s).

Tips:

* You can register and open an e-CNY wallet using mobile phone numbers from over 210 countries and regions.

* You can open an e-CNY wallet without holding a bank account with an authorized operator.

* You don’t need to visit a bank counter, provide passport/other identity information, or hold a bank account in Mainland China if opening the anonymous wallet(s). The payment cap per transaction is CNY 2,000 and the daily accumulated cap is CNY 5,000.

Top up as You Pay

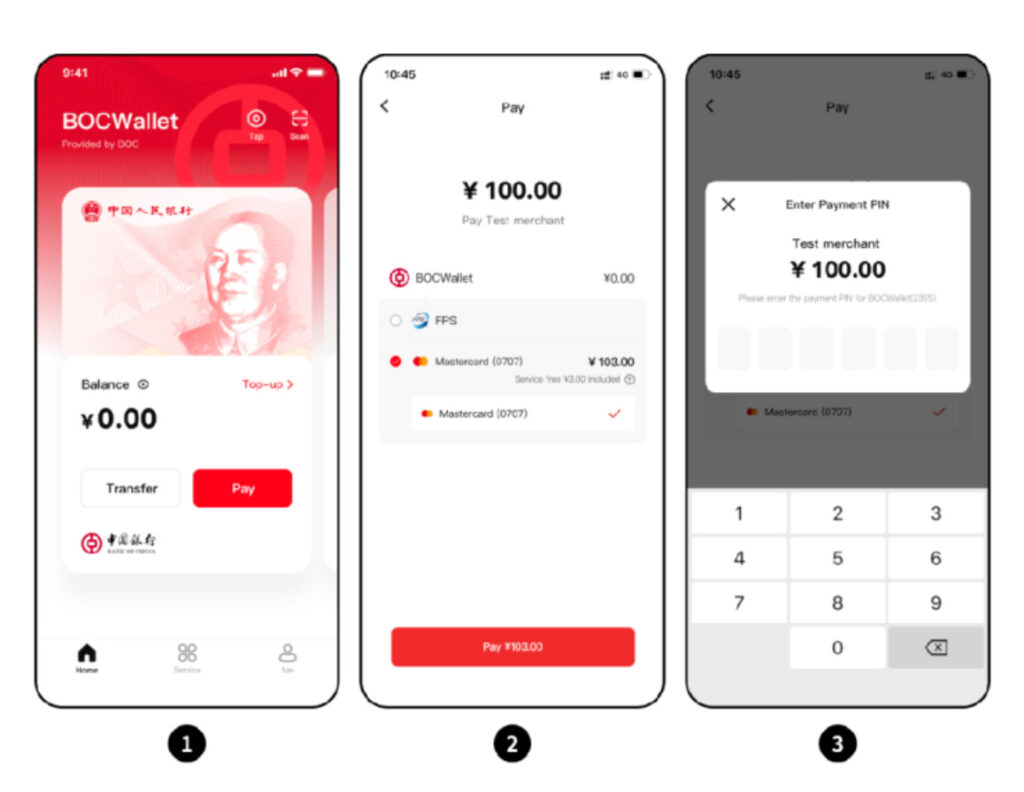

* Use features like ‘Scan-to-Pay’ or ‘Payment QR Code’ to pay merchants and follow the on-page prompts to link a bank card or select FPS (Fast Payment System) to call Honk Kong mobile banking APPs.

* By linking your International Bank Card(s) to your wallet, you can pay directly from your wallet without topping up in advance.

* Enter your wallet payment PIN and complete the payment.

Tips:

* ‘Top-up as You Pay’ supports Visa and Mastercard. More international card schemes will be supported soon.

* By now, FPS top-up is already supported by the wallets opened with ICBC, BOC, CCB, BOCOM linked to Hong Kong accounts under BOCHK, ICBC (Asia), HSBC, HSB, SCB HK, CCB (Asia), BOCOM (HK), CMB Wing Lung Bank, BEA, CNCBI, ZA Bank and DahSing Bank. Wider coverage will be underway.

Traveler Wallet

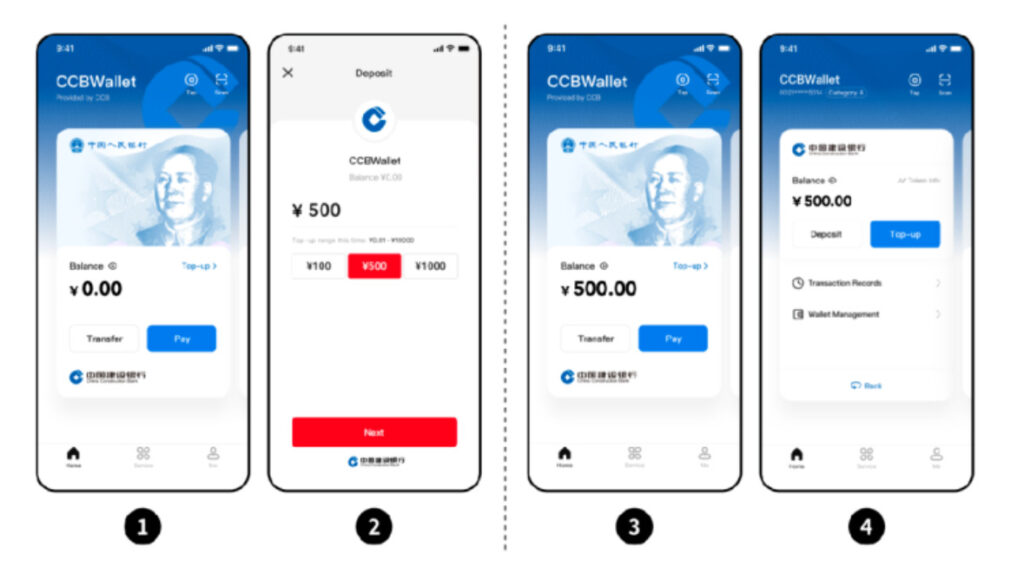

* Open a wallet in the e-CNY APP.

* Tap the ‘Top-up’ button and use a bank card to top up the wallet.

* Top up first, pay with ease. Enjoy the convenience of e-CNY and shop with a wider range of online merchants.

* Filp to the back side of the wallet and tap the ‘Deposit’ button to deposit any unused funds back into your bank account.

Tips:

* International users can also visit the authorized operator’s bank counters to top up their wallets with RMB banknotes or foreign currency banknotes. The remaining wallet balance could be exchanged for banknotes at the counter.

* Honk Kong users can top up their wallets via FPS from their local bank accounts free of charge.

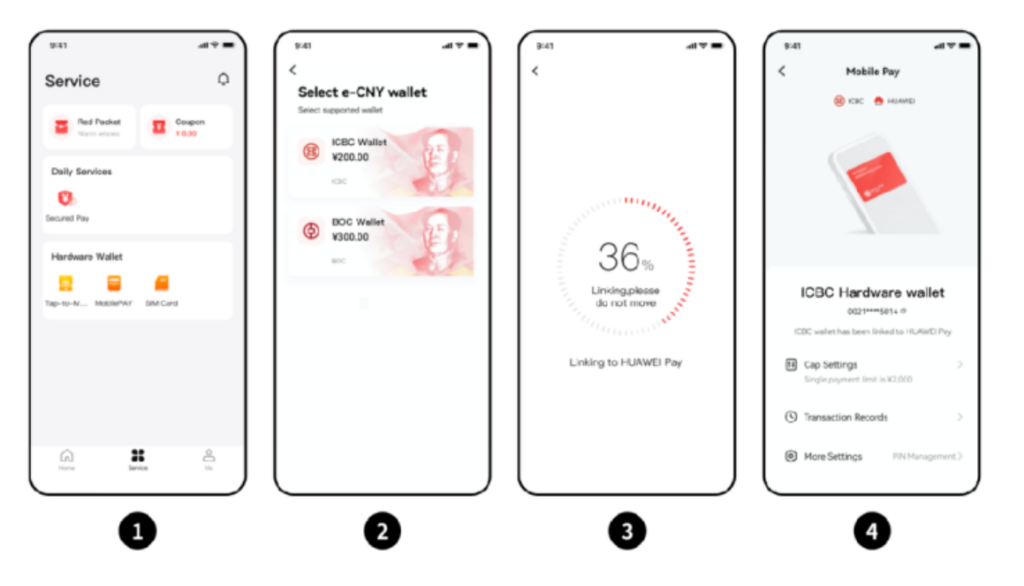

Mobile Pay

* Enable Mobile Pay by tapping ‘Mobile Pay’

* Select a wallet from any available wallet you prefer and link.

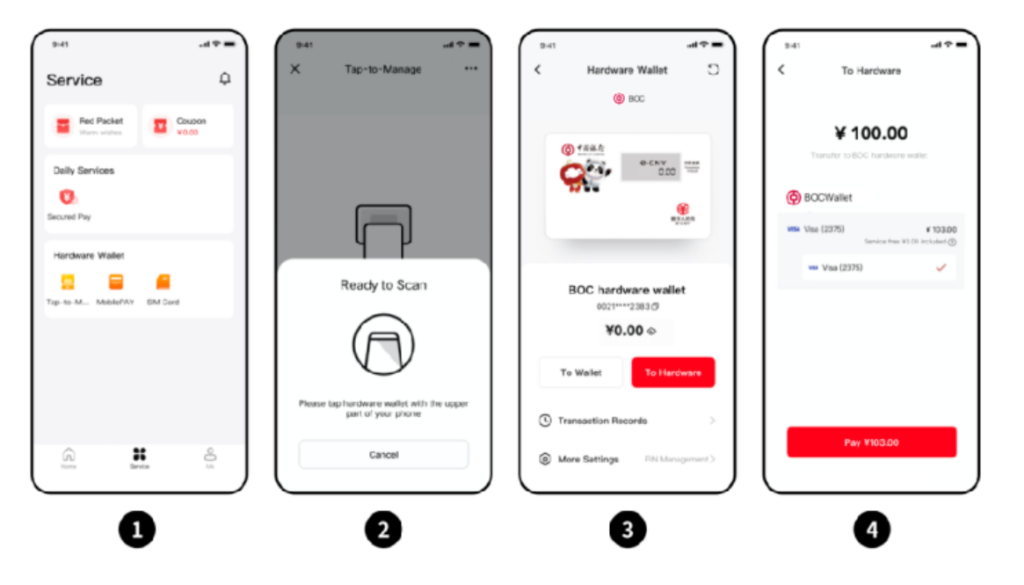

Cards/Wearable Device Hardware Wallets

* Apply for a Card or Wearable device hardware wallet at an authorized operator’s bank counters or via self-service terminals.

* Cards and Wearable device hardware wallets can also be linked to the e-CNY for easier top-up and management.

Tips:

* Mobile Pay is compatible with Android phones, and some mobile devices support out-of-power payments, allowing usage even when the phone is powered off (Please view the list of the supported devices on the Hardware Wallet page at e-CNY APP).

* Android phone users can open SIM card wallet(s) if they hold super SIM card(s) issued by China Mobile, China Telecom, or China Unicom.

China e-CNY: Scan to Pay

* Enter the order amount and choose a wallet that supports the function. Transactions can be settled directly if the wallet balance is sufficient. Otherwise, the ‘Top-up as You Pay’ function will be called to top up from the linked bank card and pay the rest.

* Enter your PIN and complete the payment.

Tips:* You can simply scan the QR code to pay at the sign of the e-CNY logo at a merchant.

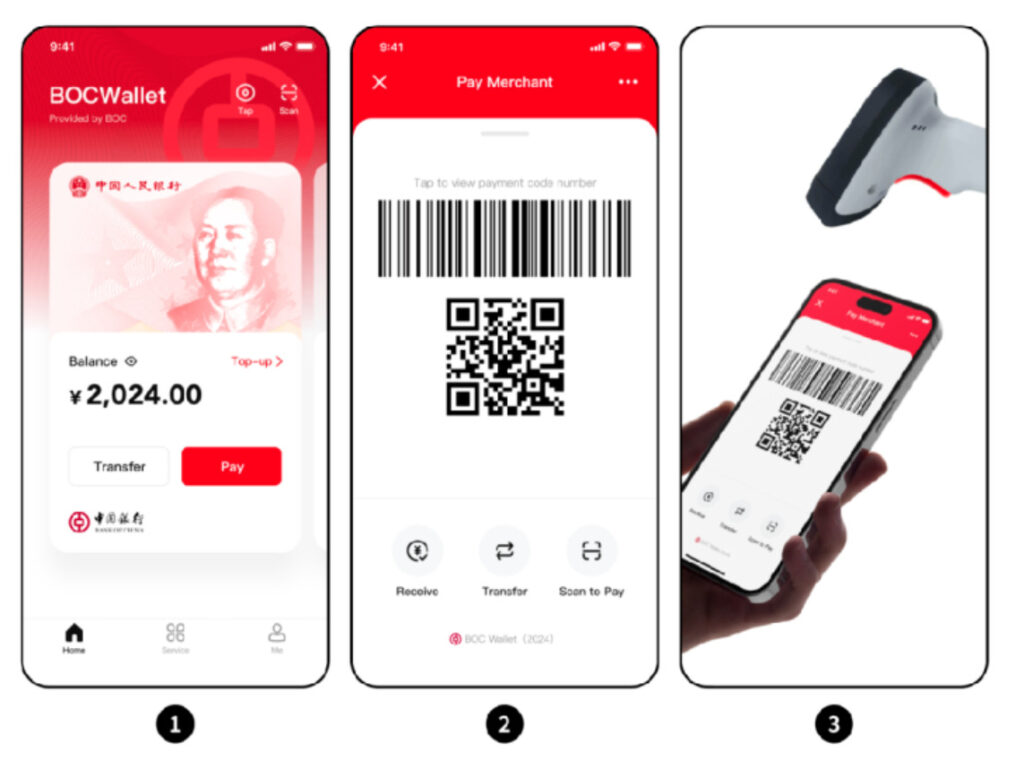

China e-CNY: Customer – presented QR Code Payment

- Tap the ‘Pay’ button or swipe up on the wallet page to activate ‘Payment QR Code’.

- Display the ‘Payment QR Code’. The merchant will then use devices such as a QR Code scanner to scan this code.

- Enjoy one-step payment of Quick Pay for payments under RMB 500. A payment PIN is required when the payment amount exceeds RMB 500.

Tips:

* The cap of Quick Pay can be set in; Me – Payment Settings – Quick Pay’.

Tap to Pay

1. Double-click the power button to display the payment page and tap the merchant’s POS machines with your phone to pay.

2. Tap the POS with a card/wearable hardware wallet directly to pay.

Tips:

* With the out-of-power payment function enabled, you can still tap the merchant’s POS to pay even when your phone is powered off.

Tap to Manage

1. Tap the ‘Tap-to-Manage’ button to read the card or wearable device hardware wallet.

2. International bank cards can be used to top up hardware wallets.

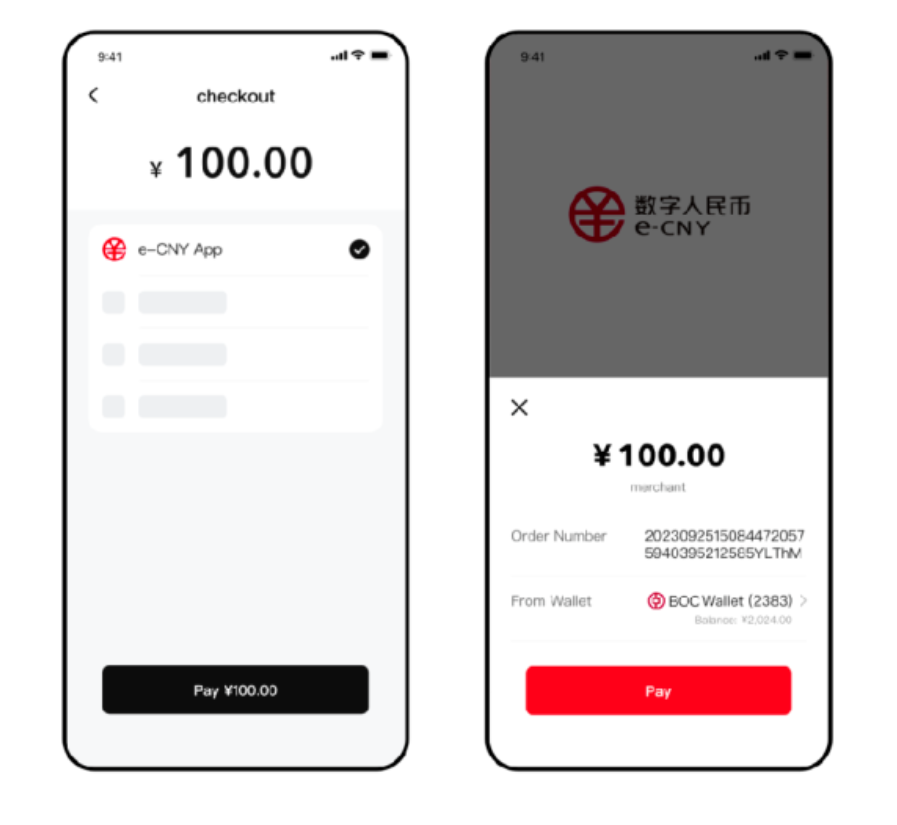

Call e-CNY APP for Online Payments

1. When using online platforms such as DiDi, Meituan, Ctrip, and Qunar, you can choose to pay with China e-CNY.

2. The Online checkout counter will call China e-CNY APP, and you can follow the on-page prompts to complete the payment.

Precautions of China Digital RMB (China e-CNY)

- Although the acceptance range of Digital RMB or China e-CNY is rapidly expanding, not all merchants support it. Confirm availability before payment.

- Be aware of exchange rate fluctuations, especially when exchanging foreign currency.

The Difference Between Paper Currency and Digital RMB (China e-CNY)

The Digital RMB or e-CNY is a digital form of legal tender issued by the People’s Bank of China, operated by designated institutions involved in its circulation and exchange to the public. It is based on a broad account system and exchanges with physical RMB on a 1:1 basis, together constituting the legal currency system.

Although Digital RMB and paper currency are both forms of the RMB, they are essentially two different payment methods with the following distinctions:

- Paper currency is primarily used for offline transactions, whereas digital currency can be used both online and offline.

- Paper currency requires the possession of a physical item, while digital currency is held and managed through a digital wallet.

- Digital currency transactions are more efficient, especially for cross-border payments. Traditional bank transfers involve multiple intermediaries and are time-consuming, whereas digital currency can achieve real-time transactions.

- Digital currency employs advanced cryptographic technology, offering higher anti-counterfeiting capabilities.

The Digital RMB is a legal base currency, and recipients may not refuse acceptance, just as they cannot refuse to accept paper RMB.

The distinction between ‘Foreigners Binding International Cards to WeChat Pay‘ and ‘China Digital RMB (China e-CNY)’

As China’s payment system diversifies, foreigners coming to China are faced with multiple payment options. Binding international cards to WeChat Pay and paying directly with Digital RMB both offer convenient payment solutions for foreigners, yet there are key differences between them.

- WeChat Pay Binding International Cards: Allows users to bind non-Chinese issued credit or debit cards to WeChat Pay, suitable for short-term visitors. May be limited by bank and regional restrictions, and additional exchange rate conversion fees may apply.

- Paying with Digital RMB (China e-CNY): Direct use of the digital currency issued by the People’s Bank of China for payments, supporting a wider range of payment scenarios without exchange rate concerns, but requires downloading a specialized digital wallet app and identity verification.

Understanding the differences between these payment methods can help foreigners in China choose the most suitable payment method based on their needs and length of stay.

The Future Impact of Using China e-CNY: Digital RMB Payments for Foreigners

As we look towards the future, the adoption of Digital RMB, or China e-CNY, by foreigners visiting China carries profound implications not only for individuals but also for the global financial landscape. This pioneering digital currency initiative is not just about facilitating smoother transactions for international visitors; it’s about laying the groundwork for a more interconnected and inclusive global financial ecosystem.

The use of China e-CNY by foreigners heralds a new era of digital finance where cross-border payments and transactions can be executed with unprecedented ease and security. This move is poised to significantly reduce the complexities and costs associated with currency exchange and international banking, making China a more accessible and attractive destination for international travelers and investors alike.

Furthermore, the Digital RMB’s integration into the global payment system represents a major step forward in the digitalization of currencies worldwide. It showcases China’s commitment to innovating its financial services and sets a benchmark for other nations to follow. As more countries explore and adopt their own digital currencies, the Digital RMB could serve as a blueprint for establishing a more cohesive digital currency network across the globe.

Conclusion

With the continuous development of the digital economy, the Digital RMB is becoming an important tool for payments for foreigners in China. Whether it’s binding international cards to WeChat Pay or using Digital RMB, understanding their characteristics and applicable scenarios will help you enjoy a more convenient and secure payment experience. Mastering these payment methods will undoubtedly add convenience to your trip to China.

In conclusion, the expansion of Digital RMB payments for foreigners coming to China is more than a convenience—it’s a visionary move that paves the way for a more connected and efficient global financial system. As we embrace the possibilities brought forth by the Digital RMB, we are stepping into a future where financial transactions are more accessible, secure, and universal for everyone, regardless of nationality.