-

{{ item.title }} {{ item.timeMate }}

CHINA COMPANY REGISTRATION REPORT

First-rate and All-round Company Registration Service in China

- The most cost-effective company registration package

Just tell us what you need, and let us do the rest. Starts at $150 to get the Feasibility Study Report first. - A comprehensive guide to starting a business in China

After the client chooses our package and signs the contract, starting at a minimum cost of $900. We will initiate the first step of the company registration process. - Advanced Company Registration Status & Procedure System

Once you place your order, you will receive your status and procedures via email in your account. - Hassle-Free Company Registration Experience

From initial consultation to the final registration, we offer an easy and straightforward path for foreign businesses to enter the Chinese market. - Making Company Registrations affordable

Dedicated online support throughout the entire process. We keep everything transparent and affordable.

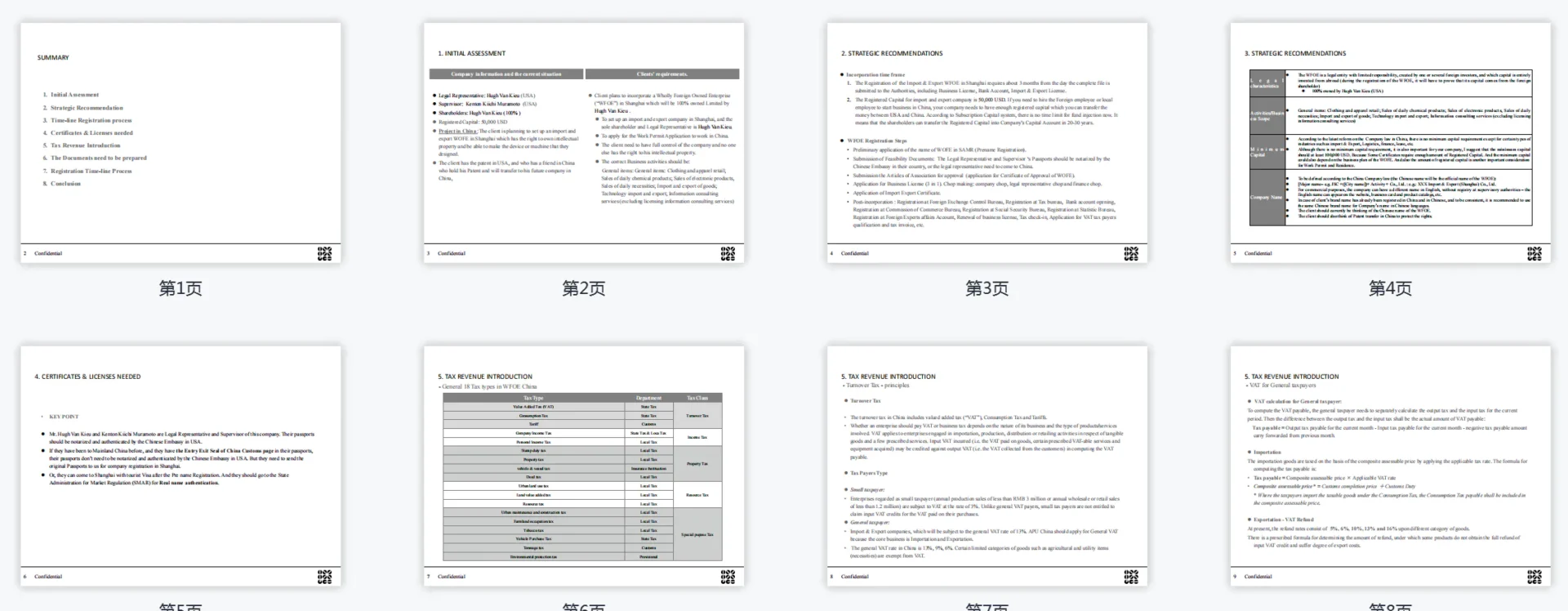

The procedure to set up a company

Set-up a Foreign Invested company in 30 Working Days

- {{ item.smallTitle }}

China Corporate Structures

The advantage of 4 typical Foreign Invested Corporations

Basic Documents Required

Documents required to set up a company in China

Passport

If the Legal representative, Supervisor, and shareholders are foreign citizens, you need to provide the Photocopy of the Passport or the Identification Certificates. Meanwhile, all the passports should be notarized and authenticated by the Chinese Embassy or consulate. But if you are in China, we just need to submit the original Passport to the SAMR.

Certificate of Proof

If the shareholder is the legal entity, the Certificate of Registration/Business Certificates for the company investor should be notarized and authenticated by the Chinese Embassy or consulate in your country. Similarly, Hong Kong, Macau and Taiwan companies should be notarized by the local registration office or authentication department only.

Registered Address

According to Chinese Company law, to set up a company need to provide the Registered Address Lease Agreement at least one year to the Government. That means you need to provide the Office Lease Contract and the Property Certificate (Copy and stamped with the property owner's chop in China). Certainly, if you don't have the company office in China, we can help you to find the company registration address in the Development Zone.

What do you get

What do you get after Company Registration

Business License

Obtaining a Business License from SAMR

Business Scope

Provide the approved business activity in the Business License

Articles of association

Company's articles of association (Basic Version in Chinese)

Stamps

Company stamp, Financial stamp, Invoice (Fapiao) seal and Legal Representative stamp

Extra service package after Company Registration

Bank Account

RMB Company Bank Account / Company Capital Account / Foreign Exchange Account, etc.

E-invoice

The companies started fully using digital Electronic invoices (E-invoice) on August 1, 2023, and will no longer issue paper VAT special invoices or VAT ordinary invoices.

Visa & Work Permit

Work visa is required for entrepreneurs who set up a company in China. After applying for a work visa, you must obtain a work permit and residence permit.

Social security account

Pension, Medical Insurance, Unemployment Insurance, Maternity Insurance, Work Injury Insurance and Housing Provident Fund for Chinese employees.

Applying for Licenses & Certificates

Assisting in applying for Special Licenses or Certificates

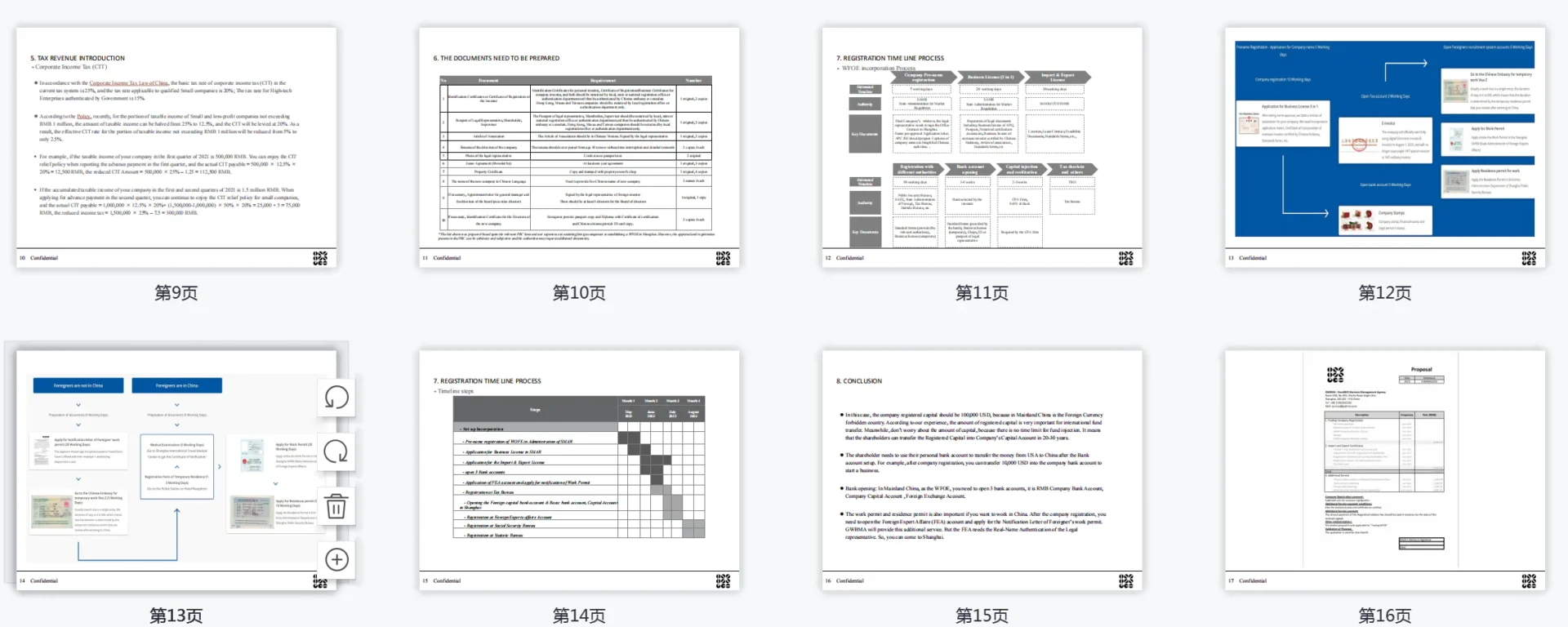

Import & Export

Trading companies in China need the process below: 1. Put on record Foreign Trade unit 2. Registration Form for Inspection and Quarantine. 3. Certificate of customs declaration Unit. 4. Foreign Exchange Administration Unit. 5. Electronic port Card.

Food Circulation License

For Food Trading companies, outlets, supermarkets, or restaurants, and Enterprises engaged in the manufacture and packaging of food, the Food License is necessary. That means you need to provide a certificate to operate the food business.

ICP License

If the company has an official website or e-commerce platform in China, it needs to apply for an ICP license. Generally, non-profit websites need to apply for the standard ICP license, and e-commerce websites need to apply for the commercial ICP.

Medical device license

If the company business activities belong to the Mid-risk medical devices or High-risk medical devices). GWBMA can help you to apply for the Medical device License in National Medical Product Administration (NMPA ).

Alcohol Wholesale/Retail

Regarding Foreign-funded Enterprises including WFOEs, units engaged in the wholesale and retail of alcohol must, within 60 days after obtaining their business license, file for registration with the State Administration for Market Regulation (SAMR) as required by government regulations, specifically declaring their operation of alcohol business.

Human Resource license

If the company's business involves providing onboarding, payroll, and employee benefits services to other corporations, it is required to apply for an HR license. This entails having a bank deposit of RMB 500,000 as registered capital and employing at least 5 staff members with Talent Market Practitioner Certificates, among other requirements

Travel & Tourism Agency

To operate a Travel & Tourism Agency in China, a company must first secure a business license and an Agency license. Initially, the agency can conduct only domestic travel operations for 2 years. Post this period, with a clean record, the agency may apply for an outbound tourism license. Additionally, a 200,000 RMB deposit is required by the Government.

Restaurant/Catering Licence

Secure a Restaurant/Catering License by submitting corporate and owner documents, passing health inspections, and ensuring staff are certified in food safety protocols. Meet regulatory benchmarks to initiate operations with legal compliance and customer safety as top priorities.

Frequently Asked Questions

Learn more about Company Registration in China

How Can I Become a GWBMA User Quickly?

To ensure the security of our services and to prevent misuse by hackers, our technicians have implemented a review process for creating an account. However, if you wish to become a user quickly, we recommend that you first directly make a payment for your order on our website and opt to create an account during this process. New users who follow this procedure will be instantly approved by our system within 3 minutes.

How much does it cost to set up a foreign-owned company in China?

The Company registration cost depends on the company type, the business scale, and the business industries. Therefore, if you want to set up a company in China, just contact us directly. We’ll analyze your company situation and then provide the most cost-saving proposal.

What is the share proportion for the Foreign-Invested Enterprise?

- For the WFOE/WOEF, the foreign investor should have a 100% shareholder ratio to set up a wholly foreign owned company in China.

- For Joint venture company, at least one of the shareholders should be a foreign investor that the proportion shall be no less than 25%.

I haven’t rented an office yet, can I set up a company first?

When setting up a company in China, it is important that you need to find an office and the lease contract with the landload who provide the copy of the real estate license, and other related materials. It is necessary for company registration. Certainly, if you need help, we can help you to find the best office or provide the registration address in the Development Zone.

What is a Joint Venture company in China?

The Joint venture (JV) is a business entity set up by one or more citizens, corporations, or economic organizations cooperating with Chinese citizens, corporations, or economic organizations. That means the shareholders are from two or more nationalities. According to the Company Laws in China, the JV company is characterized by shared ownership, shared returns and risk, and shared governance. The point is, the contribution of capitals shall be converted to a certain proportion, and the proportion of the foreign investors shall be no less than 25%.

Will the company be able to start operations after obtaining a business license?

After obtaining a business license, you need to apply for public security records, official seals, corporate seals, and financial seals. Moreover, the corporation in China needs to apply for tax registration and social security account.

What is the limit on the number of board members of a limited liability company?

If a limited liability company has a board of directors, its members are five to thirteen people. Besides, the limited liability company with a small number of shareholders or a relatively small company may have an executive director without a board of directors.

What is the Supervisor of the Foreign Invested Enterprise (WFOE/JV)?

According to the Company law, a WFOE or JV company in China is required to appoint at least one natural person as the supervisor, and this person can be of any nationality and reside in any place. The supervisor cannot be appointed as the legal representative, board members or other senior manager. However, any shareholder or employee can be nominated to serve as a supervisor. In fact, the Supervisor of a WFOE/JV has no direct authority or responsibility, and usually serves a “symbolic function” within the company.

Can a limited liability company not have a board of supervisors?

A limited liability company with a small number of shareholders or a small scale may have one to two supervisors and no supervisory board. However, the limited liability company with a relatively large scale of operations has a supervisory committee with not less than three members, and the proportion of staff representatives shall not be less than one third. Supervisors shouldn’t be the legal representative, board members or other senior manager.

Who can be the legal Representative of Foreign companies?

Setting up a company in China requires a legal representative. The legal representative can be one Chinese or a foreigner. Besides that, the legal representative may be one of the shareholders, or it may be one of the persons from the appointment system (the position is the chairman, executive director, or manager). But the legal representative should not be the supervisor.

Do I need to be physically present to register a company in China?

No, we can act as an authorized agent on your behalf to register your company and get the Business License even if you are not in China. However, the legal Representative needs to be in China in order to open the company’s bank account.

What is a branch office? Is a branch company qualified as a corporate legal person?

A branch company refers to a company that set up a business entity in a different registered area. It should be noted that the branch company does not have a legal personality, and cannot independently assume civil liabilities. Therefore, the parent company is responsible for civil liabilities.

When I have completed the order, can I view the working procedure of my order online?

Yes. Once you become a GWBMA user, you can track the status and Registration procedures of your order in your account. You can check the Company Registration process and download the relevant files from the State Administration for Market Regulation (SAMR) directly in your account. Additionally, you can download and print the invoice once your orders are completed.

How to name your company in China?

In China, the official name of a company consists of four parts: administrative region, designation name, industry characteristics, and organizational form. Firstly, the administrative region name includes different regions or cities where you register the company. Secondly, the designation name includes two or more Chinese characters. Thirdly, the industrial characteristic includes the name of the products, business, or industries such as trade, culture, technology, advertising, etc. Fourthly, the organizational form includes the limited company, liability limited company, RO, etc.

What does registered Capital Mean?

According to the New Company Law, registered capital is the fund all the shareholders contribute or promise to contribute to the company as they apply with the State Administration for Market Regulation (SAMR) for incorporation, and the amount of the registered capital will be listed in the company’s Business License. Generally, the registered capital is the total amount of capital contributions subscribed by all shareholders, which must be paid in full after five years from the company’s establishment, as prescribed in the corporate bylaws.

How to fill in the company’s business scope?

The Chinese company law stipulates that an enterprise may not operate business beyond the business scope of the business license, otherwise it will face a fine. Therefore, you must first determine the main operations to ensure that the company can legally operate these industries. If you are unsure whether to do the added business scope, you can go to the State Administration for Market Regulation (SAMR) to ask the questions. That’s why the Chinese business scope is very important for your company.

What is the WFOE/WOFE in China?

Wholly Foreign Owned Enterprise (WFOE or WOFE) refers to foreign enterprises, corporations, economic organizations, or individuals that are 100% owned and capitalized in China by foreign investors. Thus, the WFOE doesn’t include the Joint venture enterprises, Representative Offices, or the branches of foreign companies, etc. Most notably, unlike the other investment vehicles in China, the unique feature of a WFOE is that the involvement of a mainland Chinese investor is not required. That’s why the WFOE is the most popular corporation for the Foreign Invested Enterprises (FIE).

What is the Representative Office in China?

Representative Office (RO) allows a foreign company to hire staff in China through their own legal entity. That means the RO is for the sole purpose of company representation. Starting up a RO in China is the fastest way to get an income at a lesser cost. However, not only the RO cannot part-take in any activities that cause them to gain returns, but also it cannot sign up any legal documents or charge a sales service fee from any customers.

What is the difference between the branch company and the subsidiary company?

- A branch company is a branch of the company. Although the Branch company has business qualifications, it does not have legal personality, and cannot independently assume civil liabilities. The civil liability is bared by the company that establishes the branch company. In addition, the name of the branch company has to set up a branch name in front, followed by the name of the company plus a branch location.

- For the subsidiary company, a certain amount of shares of a subsidiary are held and controlled by the parent company, but they have independent legal personality. In another word, civil liability can be assumed independently and externally according to law, but the parent company is not liable for the debts of the subsidiary company. The point is that the Subsidiaries can name themselves without adding the parent company’s name.

What should I do if the Registrated Capital cannot be paid after the capital period expires?

- If the company does not intend to continue to operate, it can directly deregistration or transfer.

- It is possible to extend the capital contribution period by amending the statutes; this method should be the most cost-saving, but it must be approved by all shareholders.

- Find someone to help advance the capital, and the registered capital will actually be paid.

- Shareholders who fail to timely contribute capital can be paid by other shareholders or transfer shares.

- Go to the State Administration for Market Regulation (SAMR) pre-filing to handle the change of capital reduction.

Can I use the English Company Name as the official name for company registration in China?

According to Article 8 of China’s “Implementation Measures for the Registration and Administration of Enterprise Names”, enterprise names should only use Chinese Simplified characters that conform to national standards, and must not use Chinese pinyin letters or Arabic numerals. Meanwhile, if the name of an enterprise needs to be translated into a foreign language for use, it shall be translated and used by the enterprise itself in accordance with the principle of text translation, and there is no need to report to the Industrial and Commercial Administration Departments for approval. In this way, there are often inconsistencies and frequent changes. As a consequence, Chinese Simplified is the only language in the official record of enterprise in the People of the Republic of China.

USER REVIEWS FOR COMPANY REGISTRATION

- Reviews

- Questions

Thank you for submitting a review!

Your input is very much appreciated. Share it with your friends so they can enjoy it too!

Getting It Right from Day One!

We are truly thankful to Ms. Cindy and her team for their outstanding support. As a family preparing to start a new chapter in Shanghai, we had many questions and uncertainties, especially when it came to making smart decisions for our small business setup. Highly recommended for any family or entrepreneur planning to build something meaningful in China.

Highly Recommend!

GWBMA’s Feasibility Study Report gave us exactly what we needed to confidently move forward with our China expansion. The report was clear, professional, and tailored to our business model. Thanks to their guidance, we were able to set up our company in China much faster than expected. Their service was efficient, responsive, and highly reliable.

Highly recommended!

We are extremely pleased with the professional assistance we received during our WFOE registration process in China. The team’s expertise and thorough understanding of the legal requirements made the entire procedure seamless and efficient. Highly recommended for anyone looking to establish a presence in China.

The service is outstanding

I would like to extend my heartfelt thanks to the exceptional agents at GWBMA for their swift and efficient assistance in completing my WFOE registration in China.The service is outstanding.

company registration

It's first time for me to register a company in china. hopefully this agent help me.