Introduction:

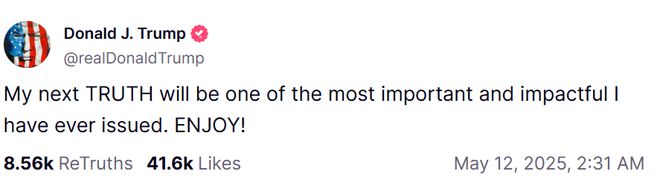

In May 2025, after years of intensifying tariff battles, the United States and China have officially resumed negotiations toward a potential China-US trade agreement. The high-level meetings in Geneva are seen as a pivotal attempt to break the deadlock and stabilize global supply chains. After the talks, former US President Donald J. Trump declared on his social platform that he would soon release “the most earth-shattering announcement” of his career—widely interpreted as a signal of a major breakthrough.

According to multiple media reports, U.S. Treasury Secretary Scott Bessent and Chinese Vice Premier He Lifeng led two days of closed-door meetings. While no official agreement has yet been published, both sides described the outcome as “constructive” and confirmed plans to establish a permanent trade dialogue mechanism. The China–US trade talks, initiated in February this year, have reached their first formal breakthrough attempt in 2025.

I. China-US Trade Agreement Negotiations Officially Restarted

In April 2025, the United States and China engaged in a rapid escalation of tariffs. On April 2, President Trump announced a 34% “reciprocal tariff” on Chinese imports, increasing the total tariff to 54%. China responded by imposing a 34% tariff on U.S. goods, effective April 10. Subsequently, the U.S. implemented an additional 50% tariff on April 9, raising the total to 104%. China countered with a 50% increase, bringing its total tariff on U.S. goods to 84%. The U.S. further raised tariffs to 145% on April 11, and China responded by increasing its tariffs to 125% on April 12.

This tit-for-tat escalation led to significant price increases for Chinese exports, including machinery, automotive components, electronics, and chemicals, with prices surging by 30% to 70%. U.S. importers faced higher costs, leading many to reduce orders, suspend operations, or delay key projects.

More critically, the price volatility in strategic resources such as rare earth elements has triggered growing alarm. Rare earths are essential for manufacturing electric vehicle batteries, missile guidance systems, precision magnets, and semiconductors. China currently accounts for over 60% of global rare earth production and nearly 90% of refining capacity. In response to U.S. tariffs, China imposed export restrictions on seven rare earth elements and related items in April, requiring special export licenses. This move disrupted global supply chains, causing prices of several rare earth metals to rise by more than 80%, exerting significant pressure on the U.S. defense and clean energy sectors.

II. Why the China-US Trade Agreement Talks Are Globally Significant

This is no longer a traditional tariff dispute—it has evolved into a structural confrontation reshaping global industrial geography. For China, the damage extends beyond export losses to deeper internal pressures: contracting demand, weakening job markets, and shrinking local government revenues. For the U.S., inflation and industrial paralysis are being directly exacerbated by trade tensions.

A senior Chinese official made a rare statement: “Prolonged confrontation benefits no one. We are willing to discuss phased tariff reductions and coordinated development in key sectors.” This reflects a clear shift in tone from Beijing, likely driven by mounting pressure from exporters and regional stakeholders.

This is arguably the most challenging external environment China has faced in nearly five decades. A growing number of Western multinational corporations are exiting the Chinese market, and Foreign Direct Investment (FDI) has dropped to its lowest point in decades. At the same time, new players—including Saudi Arabia, Indonesia, and Hungary—are establishing companies in China, seeking partnerships in technology, capacity, and financing. This “West out, emerging world in” shift illustrates a deep recalibration of global economic relationships with China.

Conclusion:

A successful China–US trade agreement could prevent further fragmentation of the global economy and restore investor confidence. If China and the United States can use this momentum to rebuild a cooperative trade mechanism, even a preliminary agreement could inject stability into a fragile global economy.

“This is not just another negotiation—it could be the turning point for the future of global supply chains.”