As global business continues to expand across borders, more foreign enterprises are conducting due diligence on Chinese companies before entering into formal relationships. A common step is ordering a China Manual Comprehensive Company Verification Report, a document that collects legal, structural, and operational data from official Chinese sources.

However, a frequent reaction after receiving the report is confusion or even dissatisfaction:

“We paid for a full company verification. Why is there no financial data included?”

This question reflects not a problem with the report itself, but a deep misunderstanding of how the financial statement in China is structured, disclosed, and interpreted. This article explains why financial information is often missing from Chinese verification reports, and what foreign clients need to know to bridge the gap between expectations and reality.

Why Foreign Clients Expect Financial Data – and Why It’s Not There

In the U.S., Europe, and many other jurisdictions, it is standard to expect company reports to include revenue, profit, assets, liabilities, and cash flow metrics. These data points are drawn from audited financial statements, which are often public or easily accessible via commercial data services like Dun & Bradstreet.

Foreign clients, familiar with these systems, naturally look for similar sections in a Chinese company verification report. When they find these financial statements missing, many assume the report is incomplete, the service is flawed, or worse, that there is a transparency issue with the target company.

But this is not the case. In China, the absence of financial data in company reports is a system-level feature, not a service-level defect.

The financial statement in China, including the balance sheet, income statement, and cash flow statement, must adhere to specific Chinese accounting standards (CAS) and be prepared on an annual basis. However, except for listed companies, most enterprises in China choose not to publish these reports. This is legal, intentional, and standard.

Real due diligence begins when foreign clients stop expecting Chinese systems to mirror their own—and start asking how China actually operates. At GWBMA, we help bridge that understanding gap, combining data access with legal insight and market knowledge.

Who Prepares Financial Statements in China, and Who Sees Them?

Every registered business in China—including private limited companies, foreign-invested enterprises (FIEs), joint ventures, state-owned subsidiaries, and partnerships—is required by law to prepare annual financial statements.

These statements include:

-

Balance sheet

-

Income statement

-

Cash flow statement

These documents form the core of the financial statement in China. They must be filed annually, including the balance sheet, income statement, and cash flow statement, must adhere to specific Chinese accounting standards (CAS) and be prepared on an annual basis.

However, they are filed directly with the local tax bureau and are not made public. These tax-filed reports are encrypted within China’s internal tax system. Even third-party agencies have no legal right to access them without explicit company authorization or government directive.

So yes, the data exists—but the vast majority of companies in China choose not to disclose it publicly unless they are listed entities or under legal obligation. This behavior is legally permitted and widely practiced across industries.

What Is the “Financial Statement in China” – And Why Is It Missing from Public Reports?

The financial statement in China refers to the annual report filed by businesses to Chinese tax authorities. These documents are fully compliant with CAS and cover all financial dimensions expected in any accounting regime. However, they serve a governmental tax function, not an external communication or investment function.

Key characteristics include:

-

Prepared entirely in Chinese, using locally defined accounting terms

-

Submitted through the tax system, not the public commercial registry

-

Not available to third parties without company consent

-

Primarily structured for tax reporting purposes, not external evaluation

This means that even though the financial statement in China is real and accurate for regulatory purposes, it is not publicly visible—nor is it expected to be.

Even If You Get the Tax Report, Can You Understand It?

Some clients ask: “What if I can somehow obtain the verification report? Can I then use it to assess the company?”

In reality, the answer is often no.

Reasons include:

-

The documents are in Chinese, often with dense and technical terms

-

CAS categories differ significantly from IFRS or US GAAP

-

The financial statement in China is designed for tax compliance, not investment due diligence

-

Many companies use lawful methods to minimize taxable income, making profit margins appear artificially low

-

Revenue recognition, asset valuation, and cost structures may follow policies unfamiliar to foreign analysts

Even if the financial statement appears simple on the surface, its interpretation requires deep local accounting knowledge, as well as awareness of industry-specific tax planning techniques common in China.

Tips: Please read this article: Tax-Financial Version in China and U.S Tax Records.

Why Most Chinese Companies Choose Not to Disclose Financial Statements

Chinese law permits companies to opt out of publishing financial data in their public annual filings. This practice is widely used, especially among non-listed firms.

The rationale includes:

-

Preventing competitors from accessing the financial strategy

-

Protecting business owners’ private equity or shareholder structure

-

Avoiding misunderstandings from tax-optimized (but low-profit) reports

-

A cultural preference for financial discretion over financial transparency

This practice is known locally as “企业选择不公示” (translated as “the company chooses non-disclosure”), and it is perfectly legal under current Chinese regulatory policy.

Even among foreign-invested enterprises, joint ventures, and subsidiaries of state-owned groups, financial data is often withheld from public view.

What About Different Company Types – Do They Disclose Financial Data?

Here is how different business types in China generally handle financial disclosure:

| Company Type | Financial Filing Required | Public Disclosure Required | Common Disclosure Practice |

|---|---|---|---|

| Publicly Listed Company | Yes | Yes | Mandatory Disclosure |

| Foreign-Invested Enterprise (FIE) | Yes | No | Usually Not Disclosed |

| Private Limited Company | Yes | No | Rarely Disclosed |

| State-Owned Subsidiary | Yes | No | Often Confidential |

| Joint Venture | Yes | No | Case by Case |

Why Foreign Clients Misread the Situation

The confusion stems from a fundamental mismatch between international and Chinese expectations:

-

Foreign clients expect company verification reports to resemble those in their home country

-

They assume financial data is public or at least available through paid reports

-

They equate non-disclosure with non-compliance or risk

-

They misattribute the absence of financial data to the service provider, rather than China’s legal framework

This misunderstanding can lead to:

-

Incorrect assessment of business risks

-

Unnecessary mistrust of legitimate Chinese companies

-

Frustration with third-party reporting agencies

-

Missed opportunities due to systemic misinterpretation

What Can Clients Do If They Truly Need Financial Data?

There are options—though none are as straightforward as in the West:

-

Request the company to voluntarily provide audited financials

-

Include financial disclosure clauses in commercial contracts

-

Work through trusted partners or legal counsel to request internal data

-

Use alternative indicators like registered capital, operational history, tax ratings, and licenses to triangulate credibility

-

Engage local professionals to interpret the Chinese financial statement correctly if obtained

Understanding the Financial Statement in China Is the Starting Point for Real Due Diligence

A company’s financial data availability reflects not only regulatory obligations but also cultural norms, legal privacy, and risk management logic. The real risk is not in what’s missing from the report. It’s in misunderstanding why it’s missing.

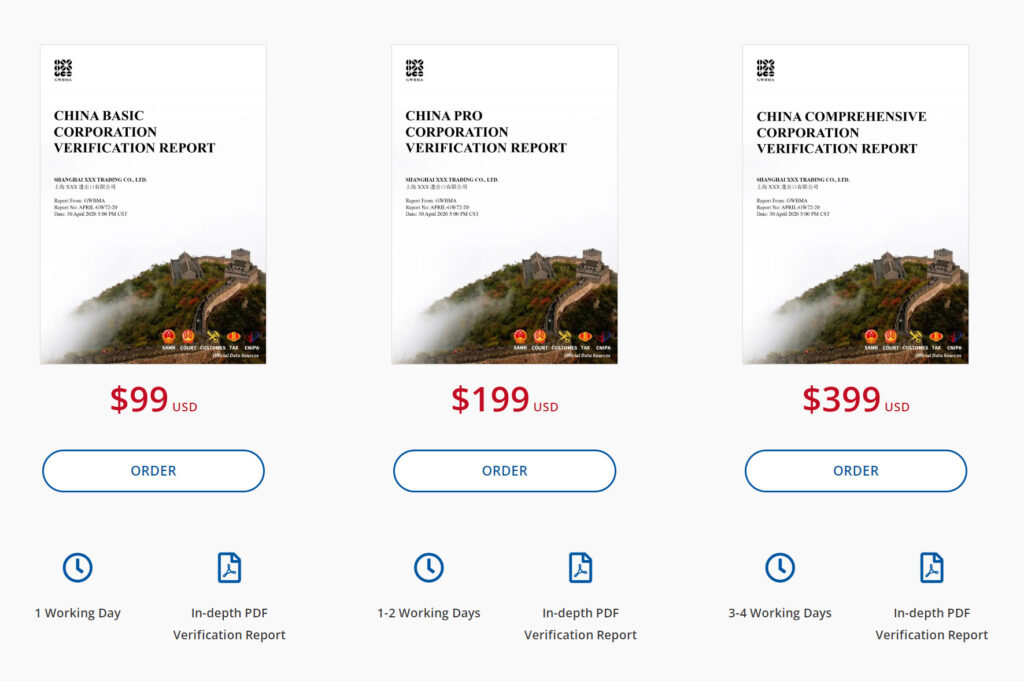

GWBMA provides the most professional and in-depth company verification services in China, helping foreign clients navigate structural limitations with clarity, precision, and strategic insight.