Contents

Introduction:

In the fast-paced economic landscape of China, businesses operate within a framework that is not only driven by profit margins and market expansion but also by an increasing emphasis on social responsibility. Social Insurance in China is essential for every employer and employee, offering protection and financial support in several key life events.

Social Insurance, consisting of various types of mandatory insurance schemes, serves as a cornerstone of this responsibility, directly impacting the well-being of millions of workers and their families. It is a pivotal mechanism by which the state and businesses contribute to the social welfare system, shaping the socioeconomic fabric of society. This article aims at educating companies about their obligations regarding the importance of social insurance in China.

China Social Insurance: One that Aligns Economic Aspirations

Despite their critical importance, social insurance contributions are sometimes perceived by companies as a burdensome financial charge, rather than an investment in a stable and resilient workforce. However, as China continues to rise as a global economic power, the role of companies in the social insurance domain has never been more important. Complying with social insurance obligations not only secures a safety net for employees but also reinforces the social contract between employers and employees, fostering an environment of mutual trust and long-term sustainability.

At the heart of this discussion lies the realization that businesses in China are not insulated entities solely focused on internal metrics of success; rather, they are integral components of the larger social ecosystem. Thus, their contributions to social insurance are a testament to their commitment to social harmony and collective progress. It is through such contributions that companies can manifest their corporate citizenship and promote a healthier, more equitable society.

To fully grasp the significance and the multifaceted impact of social insurance obligations in Chinese companies, it is essential to examine the nuances of this requirement from a holistic perspective. Such an exploration inevitably leads to an appreciation of the balanced approach that companies must adopt: one that aligns economic aspirations with social imperatives.

Understanding of Social Insurance in China

In the People’s Republic of China, the concept of social insurance is far more than a financial safety net; it is a socio-economic commitment written into the fabric of its society. Social insurance programs are designed to provide workers and their families with income security and access to essential health and welfare services. For companies, these programs are not optional but a mandatory component of their operations, deeply rooted in legislation and reflective of the country’s values of collective welfare and individual dignity.

The social insurance system in China comprises several key programs:

1. Pension Insurance:

This is the foundation of the retirement system, providing elderly citizens with financial support upon retirement. Companies are required to contribute to their employees’ pension funds, ensuring a dignified post-retirement life.

2. Medical Insurance:

With China’s vast population, access to healthcare is critical. Medical insurance helps cover employees’ medical expenses and promotes their physical well-being, which in turn can boost productivity and reduce absenteeism.

3. Unemployment Insurance:

This offers financial assistance to employees who have lost their jobs, mitigating the impact of unemployment on individuals and society while helping stabilize the economy during downturns.

4. Work-related Injury Insurance:

This protects employees who suffer from workplace injuries or occupational diseases, covering their medical costs and providing income security during recovery.

5. Maternity Insurance:

Given the importance of family in Chinese culture, maternity insurance supports women during pregnancy and childbirth, offering financial benefits and job security.

Each of these programs showcases China’s commitment to its citizens at different stages of life, ensuring that no one is left behind. For a company, investment in social insurance is an investment in its most valuable asset: its human capital. It demonstrates to employees that their welfare is a prioritized concern, breeding loyalty and attracting talent that seeks more than just a paycheck.

Moreover, social insurance encompasses not only the interests of individual employees but also the stability of their families and the broader community. By participating in these programs, companies play a direct role in enhancing the collective quality of life.

Yet, the complexity of China’s social insurance landscape requires expert navigation. Regulatory changes, contribution calculations, and cross-provincial policies can be a labyrinthine task for the uninitiated. It’s in this context that compliance becomes a challenge, but also an opportunity—a chance for companies to show leadership in corporate social responsibility.

The success of fulfilling social insurance responsibilities not only benefits the immediate company workforce but also reverberates throughout Chinese society, contributing to the broader vision of a harmonious and prosperous nation.

China Social Insurance: Benefits of Compliance for Companies

Aligning with social insurance regulations in China is not solely a matter of adhering to legal standards; it represents strategic foresight for companies seeking long-term stability and growth. The benefits of compliance extend beyond the moral high ground to tactical advantages that can distinguish a company in a competitive marketplace.

1. Attracting and Retaining Talent of Social Insurance in China:

Companies known for responsible social insurance practices are more attractive to prospective employees. In a market where skilled workers have multiple options, a reputation for caring for employee welfare can be a decisive factor. Furthermore, employees who feel secure in their welfare benefits are more likely to remain with a company, reducing turnover and associated costs.

2. Brand Reputation and Customer Loyalty:

Consumers worldwide are increasingly aware of corporate social responsibility (CSR). Companies that can demonstrate a genuine commitment to their employees’ welfare may enjoy enhanced customer loyalty and brand reputation. This is particularly relevant in China, where social harmony is a valued principle.

3. Operational Continuity:

Compliance ensures that companies avoid fines and penalties related to non-compliance. This not only saves money in the short term but safeguards the company’s operational continuity, unimpeded by legal hurdles or government scrutiny.

4. Employee Productivity of Social Insurance in China:

Employees who are not worried about their health, retirement, or potential unemployment are more likely to focus on their work, leading to increased productivity. Peace of mind translates to more energetic and attentive employees in the workplace.

5. Social Stability Contribution:

By contributing to the social insurance system, companies actively contribute to the stability and well-being of society at large. This ensures a more stable socio-economic environment, within which businesses can operate more predictably and successfully.

6. Investor Appeal of Social Insurance in China:

Ethical business practices, including full compliance with social insurance programs, can make companies more appealing to investors. With the global investment community increasingly valuing sustainability and corporate ethics, adherence to social insurance requirements becomes an aspect of a company’s investment profile.

Nevertheless, compliance is not an automatic guarantee of these benefits. It requires careful planning, communication, and constant attention to regulatory changes. Companies must view it as a dynamic part of their business strategy, one that demands as much attention as any other aspect of managing a successful business.

By embracing their social insurance obligations, companies in China can indeed turn what is often viewed as a mandatory burden into a competitive edge—cultivating a loyal workforce, a strong corporate image, and a robust positioning for long-term success.

Societal Impact of Social Insurance in China

The fabric of society is often measured by the well-being of its members, particularly those who are employed and contribute to the economic engine. When Chinese companies rigorously adhere to social insurance obligations, the ripple effects are felt across the nation. These effects are not limited to individual benefits but extend to the collective prosperity and stability of society.

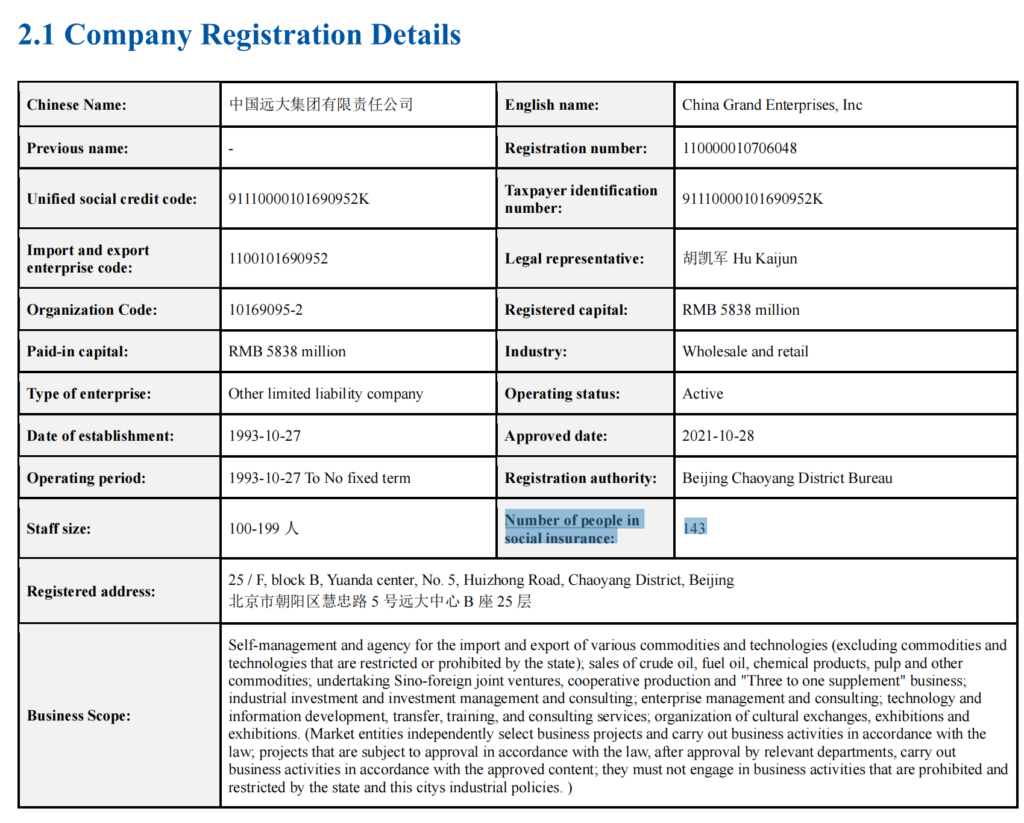

For example, the following MANUAL COMPANY VERIFICATION REPORT is a case of a Limited company owned by the Chinese government.

1. Poverty Reduction of Social Insurance in China:

Adequate social insurance mitigates the risk of individuals falling into poverty due to unexpected life events such as illness, workplace injury, or unemployment. When companies fulfill their part, they help build a safety net that catches citizens before they fall into hardship, reducing the social and financial costs associated with poverty.

2. Healthier Workforce:

With proper medical insurance in place, employees are more likely to seek preventative care and timely treatments, leading to a healthier workforce. This, in turn, can reduce the spread of communicable diseases and lessen the burden on public health services.

3. Promoting Equity of Social Insurance in China:

Social insurance is an instrument of social equity. By demanding contributions proportionate to salaries, it ensures that all segments of the workforce are catered to, from blue-collar workers to white-collar executives. This reinforces the principle of equality before the law and equity in access to social resources.

4. Enhanced Social Stability of Social Insurance in China:

By minimizing socio-economic disparities and offering a measure of security to every employed individual, social insurance serves as a stabilizing force within society. It acts as a buffer against social unrest that may arise from economic inequalities or the lack of a social safety net.

5. Economic Resilience:

Social insurance programs foster economic resilience by ensuring that, even in times of personal crisis, citizens can maintain their purchasing power, which in turn sustains domestic consumption—a vital component for the continuous cycle of economic activity.

6. Investment in Human Capital of Social Insurance in China:

Ultimately, social insurance is an investment in human capital, ensuring that the workforce remains skilled, healthy, and secure. The benefits of this investment are manifold, including better educational outcomes for the next generation and a more robust and innovative economy.

The long-term societal benefits of a robust social insurance system are abundantly clear: reduced inequality, increased public health, and economic stability. Companies in China that recognize and act upon their social insurance responsibilities thus play a pivotal role in crafting a resilient and equitable society. Their compliance is a marker of their commitment to not only the individual but also society’s collective future.

Challenges and Management of Social Insurance Duties

The landscape of social insurance in China presents a unique set of challenges to companies, especially those with diverse and expansive workforces that span multiple provinces, each with its own set of regulations and contribution rates. Ensuring compliance within this intricate framework requires a nuanced approach, balancing legal obligations with practical considerations.

1. Regulatory Complexity:

Navigating China’s complex and ever-evolving social insurance regulations is a significant challenge. Regulations may differ not just provincially but also locally, with cities within the same province having different implementation rules. Staying abreast of these frequent changes necessitates dedicated resources and expertise.

2. Administrative Burdens:

The administrative workload for managing social insurance contributions can be substantial, especially for large companies. It involves meticulous record-keeping, accurate calculation of contributions, and timely submissions to multiple administrative bodies.

3. Cost Management:

For many businesses, social insurance contributions represent a significant portion of their labor costs. Optimizing these costs without compromising on compliance or employee welfare requires strategic planning and financial acumen.

4. Cross-Border Challenges:

Companies with a mobile workforce or expatriates face additional hurdles in aligning contributions with varying national and international standards, adding another layer of complexity to compliance.

5. Enforcement and Penalties:

The Chinese government is progressively tightening enforcement and penalties for non-compliance. This includes fines, legal repercussions, and potentially negative publicity, which can affect a company’s brand and reputation.

Despite these challenges, there are several strategies and tools that companies can employ to efficiently manage their social insurance duties:

*Expert Consultation: Engaging with professionals who specialize in Chinese labor law and social insurance can help navigate regulatory complexities.

*Technology Solutions: Implementing robust payroll and HR systems that can automate calculations, maintain records, and stay updated with the latest regulations can significantly ease administrative burdens.

*Training and Development: Regular training for HR staff on the latest social insurance protocols can prevent errors and ensure that companies remain compliant.

*Risk Assessment: Conducting regular audits and risk assessments can help identify potential areas of non-compliance and rectify them before they escalate into larger issues.

*Collaboration with Authorities: Building a collaborative relationship with local social insurance authorities can provide insights into best practices and foster corporate transparency.

In this environment, services such as registrationchina.com provide essential support to companies. They offer end-to-end solutions for navigating the nuances of Chinese social insurance, from initial registration to ongoing compliance management. Utilizing such services allows companies to outsource complexities while remaining confident in their compliance stance.

Social Insurance in China: Strategic Implications for

The role of social insurance in China is to provide a safety net for its citizens, contributing to the overall stability and prosperity of the nation. For businesses operating within the country, participation in the social insurance system is not merely a legal requirement; it represents an integral component of their social license to operate. It is through these mechanisms that companies can contribute to societal cohesion and secure not just the welfare of their employees, but also the goodwill of the communities they serve.

Embracing social insurance responsibilities can yield significant benefits for companies, including:

1. Enhanced Employee Morale:

A strong commitment to social insurance illustrates a company’s dedication to its employees’ health and future, which can increase morale, improve retention rates, and attract high-quality talent.

2. Risk Mitigation:

Full compliance helps avoid substantial fines and reputational damage that can arise from failing to meet social insurance obligations.

3. Long-term Cost Savings:

Effective management and planning of social insurance contributions can lead to long-term cost savings, allowing for more predictable budgeting and financial control.

4. Corporate Reputation:

Demonstrating a commitment to social welfare aligns with China’s broader social values, which enhances a company’s reputation and brand image in the eyes of consumers and potential business partners.

5. Social Stability Contribution:

By investing in social insurance, companies contribute to the social stability of China, which fosters a stable business environment necessary for long-term business operations.

In light of these insights, it is strategic for businesses to not only remain compliant with the current social insurance legislation but also to anticipate changes within this dynamic landscape. Forward-thinking companies will recognize that their role in social insurance is a reflection of their values and a measure of their long-term strategic positioning in China.

Conclusion:

As the Chinese market continues to evolve, so too will the intricacies of its social insurance system. Companies that maintain agility, staying informed and prepared, will navigate these changes most effectively. Services such as GWBMA, professionals in Chinese labor law, and robust HR systems are tools that businesses can leverage to ensure compliance and demonstrate their commitment to corporate citizenship.

Ultimately, the successful integration of social insurance responsibilities into business models will depend on a company’s ability to view these obligations not as burdens, but as investments in its workforce and society. Doing so will not only safeguard employees but will also position businesses as pillars of a prosperous economic future for China.