Contents

China Annual Report analysis is essential for anyone looking to grasp the full scope of a company’s performance within the rapidly evolving Chinese market. These reports provide a comprehensive overview of a company’s financial stability, strategic initiatives, and operational successes. This article serves as a guide to understanding the structure, essential elements, and interpretation of China Annual Reports, offering insights crucial for investors, business partners, and market analysts. With this knowledge, stakeholders can make informed decisions when evaluating the potential and challenges of engaging with Chinese companies.

China Annual Reports of companies: The Legal Landscape and Reporting Obligations

The Company Law of China, as stipulated in Article 175, places a legal obligation on companies to compile financial accounting reports after each fiscal year. These reports, which must be audited and verified as per the law, encompass a range of financial statements and detailed subsidiary tables:

1. Balance Sheet (资产负债表):

Reflecting the company’s assets, liabilities, and equity at a specific point in time.

2. Income Statement (损益表):

Detailing the revenues, expenses, and net income over a fiscal year.

3. Statement of Changes in Financial Position (财务状况变动表):

Illustrating the changes in the company’s financial position due to operations, investments, and financing activities.

4. Financial Situation Explanation (财务情况说明书):

Providing a narrative explanation of the company’s financial condition.

5. Profit Distribution Statement (利润分配表):

Outlining the distribution of profits among shareholders. While SMEs are exempt from the public disclosure of China annual reports, they are still bound by these reporting requirements, ensuring a level playing field in terms of regulatory compliance.

What is the China Annual Report: The Role of Manual Company Verification Reports

In addition to the mandated financial statements, Manual Company Verification Reports offer a deeper dive into a company’s operational metrics. These reports can reveal the number of individuals insured under social security, which serves as a proxy for the company’s workforce size. A Zero Legal Case in this regard indicates the absence of a formal employee base, which could signal a virtual or shell company.

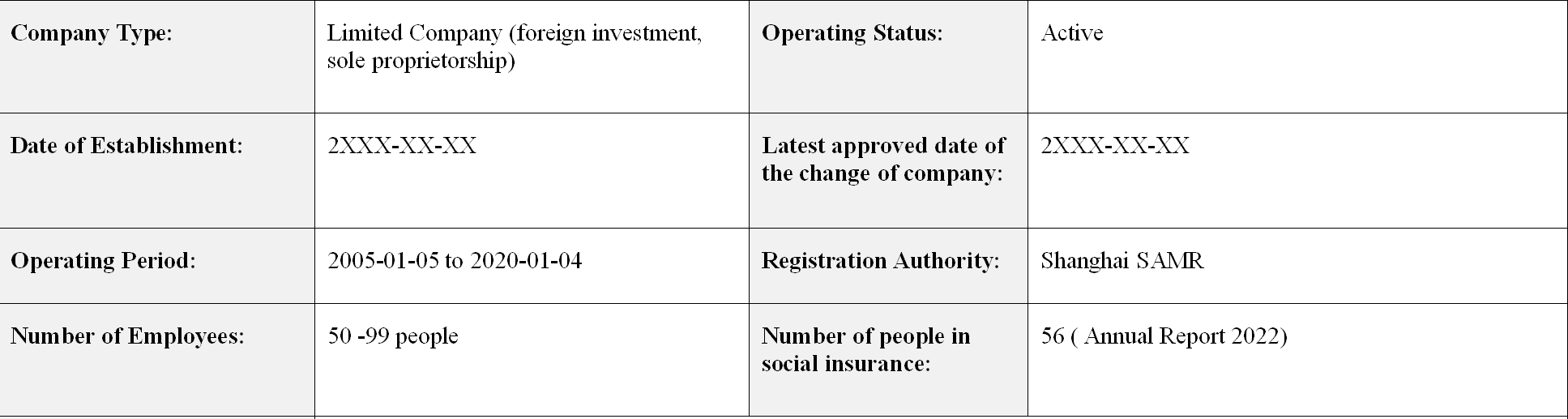

This is an example:

The Significance of Employee Numbers in China Annual Reports

The disclosure of employee numbers through China annual reports, even for SMEs that opt not to disclose their reports, is a critical aspect of corporate transparency. This information allows potential partners and investors to gauge the company’s operational scale and human resource management, which are key indicators of a company’s stability and growth potential.

The Role of GWBMA China Annual Report Reports

GWBMA specializes in crafting comprehensive Manual Company Verification Reports that align with China’s legal requirements. These reports offer a detailed overview of a target company’s financial health, operational status, and workforce, equipping clients with the necessary information for informed decision-making when engaging in business with Chinese enterprises.

The Impact of China Annual Reports on Investment Decisions

Investors rely on China’s annual reports to assess a company’s financial stability, profitability, and prospects. For foreign investors, understanding the nuances of China’s corporate reporting can be a decisive factor in their investment decisions. The China annual report provides a snapshot of the company’s past performance and future outlook, which is invaluable for investors seeking to mitigate risks and maximize returns.

The Role of China Annual Reports in Corporate Governance

China’sAnnual reports are not only financial documents but also instruments of corporate governance. They demonstrate a company’s commitment to transparency and accountability, which are essential for building trust with stakeholders. In China, where the regulatory environment is evolving, China’s annual reports play a pivotal role in showcasing a company’s adherence to legal and ethical standards.

Challenges and Opportunities in Chinese Corporate Reporting

Despite the legal framework for China’s annual reports, there are challenges in ensuring the accuracy and reliability of the information disclosed. Issues such as corporate fraud, insider trading, and financial misrepresentation can undermine the integrity of annual reports. However, these challenges also present opportunities for companies that prioritize accurate reporting and ethical business practices to stand out in the market.

Future Trends in Chinese Corporate Reporting

As China continues to integrate into the global economy, its corporate reporting practices are expected to evolve. With the push for international standards and increased scrutiny from investors, Chinese companies will likely adopt more transparent and standardized reporting practices. This shift will not only enhance the credibility of Chinese enterprises but also facilitate cross-border investments and collaborations.

Conclusion:

The China’s annual report is a vital document for Chinese companies, serving as a testament to their financial performance, operational efficiency, and commitment to legal compliance. For businesses and investors, understanding the intricacies of these reports is crucial for making informed decisions in the Chinese market. With the right tools and resources, such as the MANUAL COMPANY VERIFICATION REPORT and the INSTANT AUTOMATED COMPANY REPORT provided by GWBMA, stakeholders can navigate the complexities of China’s corporate landscape with confidence and clarity. As China’s corporate reporting practices continue to mature, they will play an increasingly important role in fostering trust, facilitating cooperation, and driving sustainable growth in the global business environment.