Introduction:

Over the past decade, particularly following the pandemic, the concept of “Southeast Asia” has become a central focus for entrepreneurs, business owners, and investors worldwide. Not because it’s the cheapest, but because it’s on the rise. Among these countries, Vietnam has emerged as a representative of this trend.

From supply chain restructuring and capital migration to the unleashing of young demographic potential and the reevaluation of the Vietnamese market by Western brands and platforms, Vietnam has become a real-world “window” for observing future supply chains, understanding cross-cultural adaptation, and rethinking the meaning of entrepreneurship in the new world order.

This article explores the topic of “Doing Business in Vietnam” from my perspective, covering macroeconomic trends, institutional logic, religious and linguistic contexts, multinational corporate strategies, and practical insights from Chinese entrepreneurs, to provide a cross-cultural and cross-institutional implementation guide.

Doing Business in Vietnam: The Capital’s Rising Role in Vietnam’s Business Landscape

Hanoi, the capital of Vietnam, is not just a political center—it is fast becoming a strategic node in the region’s economic transformation. As the administrative heart of the country, Hanoi offers policy access, government engagement, and proximity to decision-making bodies, making it a preferred location for international chambers of commerce, regional headquarters, and industry associations.

But beyond politics, Hanoi is now a magnet for foreign investors and entrepreneurs seeking both stability and opportunity. The city has invested heavily in infrastructure, education, and logistics, positioning itself as a northern hub that connects seamlessly with China’s supply chain while maintaining its unique cultural and regulatory identity. Unlike Ho Chi Minh City, which is often seen as more commercially aggressive, Hanoi provides a more structured, policy-oriented environment—ideal for enterprises focused on long-term planning, public-private partnerships, or manufacturing relocation with government support.

The appeal of Vietnam for businesses lies in its rare combination of demographic dividends, political stability, cost efficiency, and increasing integration into global trade systems. Companies are drawn not just by tax incentives or low labor costs, but by the broader ecosystem: free trade agreements, a tech-savvy workforce, and a government that actively listens to economic stakeholders. In this context, Hanoi is both a symbol and an engine of Vietnam’s ascent.

Photographer: Mandy Zhong

Understanding Vietnam: GDP Growth, FDI Patterns, and Societal Fundamentals

Language: Vietnamese as the Main Language, English as a Bridge, and French as a Legacy

The official language of Vietnam is Vietnamese, written in a Latin-based phonetic script with clear tonal distinctions. Due to the country’s colonial history, French still holds some cultural significance among the older generation and in certain institutions. However, English is the most practical language in the modern business environment.

Today, young Vietnamese commonly speak English, especially in foreign-invested and export-oriented companies where English is used daily. Chinese is less commonly spoken, mainly in areas with strong Chinese business involvement.

Religion and Cultural Values: Rooted in Buddhism with Multireligious Coexistence

Approximately 45%–50% of the Vietnamese population practices Buddhism (mainly Theravāda Buddhism), which underpins social values of harmony, order, and family.

- Catholicism accounts for about 7%, mostly concentrated in southern cities.

- Indigenous religions such as Cao Dai and Hoa Hao are unique to Vietnam.

- Minority groups include Muslims and Protestants.

While religion does not dominate policy or the economy, it subtly influences public holidays, social customs, and corporate culture. Understanding local Buddhist festivals and ancestral worship traditions is essential for cross-cultural management.

Political System: Centralized Authority with Local Flexibility

Vietnam is a socialist republic led by the Communist Party. National policies are set centrally, but local governments exercise considerable discretion in implementation. Historically, Vietnam transitioned from royal dynasties (e.g., the Nguyễn dynasty), to French colonial rule, and declared independence in 1945 under Hồ Chí Minh.

Today, foreign enterprises must navigate both central and local administrative processes when securing land, licenses, and access to industrial zones. While national policies are clear, local execution often depends on relationships and trust, making informal communication and local teams critical.

Photographer: Mandy Zhong

Doing Business in Vietnam: Sector Opportunities Driven by GDP Growth and FDI

GDP Growth: A Structural Climb, Not a Temporary Surge

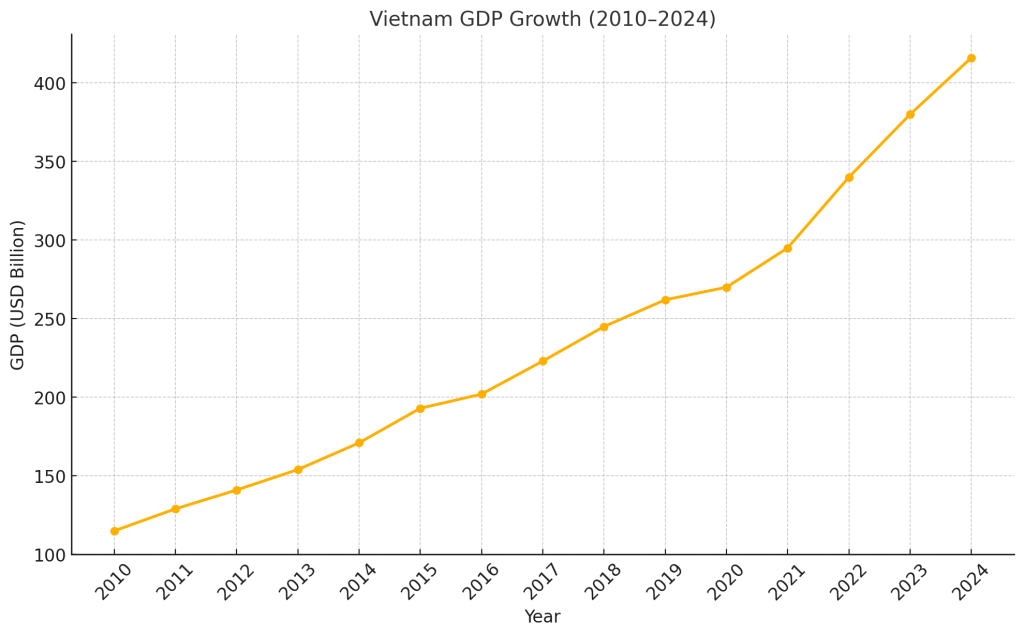

From 2010 to 2024, Vietnam’s GDP grew from approximately USD 115 billion to over USD 416 billion, maintaining an annual growth rate of 6%–7%. This wasn’t driven by short-term booms, but by long-term gains in manufacturing, exports, and demographic advantages.

Even after the COVID-19 shock in 2020, Vietnam’s economic resilience remained strong: 8.02% growth in 2022, 5.05% in 2023, and a rebound to 7.09% in 2024. Foreign investors value continuity over one-time surges.

Here is the chart showing Vietnam’s GDP growth from 2010 to 2024. The data reflects a consistent upward trend, with GDP increasing from approximately $115 billion in 2010 to an estimated $416 billion in 2024. The annual growth averages around 6%–7%, aligning with commonly cited macroeconomic reports and IMF projections.

Three structural drivers:

- Demographics: Average age of 32, with labor force exceeding 70% of the population.

- Export-led economy: USD 372 billion in exports in 2023.

- Trade agreements: RCEP, CPTPP, and EU-Vietnam FTA enhancing market connectivity.

FDI Allocation: Strategic Industrial Relocation

In 2023, Vietnam received USD 23 billion in FDI, concentrated in four sectors:

- Electronics and High-Tech Manufacturing (60%) Includes smartphones, monitors, camera modules, etc. Samsung, LG, Foxconn, Luxshare, and BYD have all invested. Samsung has invested over USD 17 billion in Vietnam, making it the company’s largest smartphone production base. Intel established its core Asian packaging and testing plant in Ho Chi Minh City. Apple is gradually shifting assembly lines to Northern Vietnam through partners like Luxshare and BYD. Japanese firms like Sony, Kyocera, and Canon are also expanding.

- Textiles and Light Industry (20%) Vietnam is now the world’s third-largest footwear exporter. Nike, Adidas, and Uniqlo are expanding orders in Vietnam. German and Belgian firms are investing in sustainable fibers and green apparel manufacturing.

- Food and Agricultural Processing (10%) French companies like DANONE and Carrefour are advancing cold chain logistics and dairy processing. Thailand’s CP Group dominates large segments of Vietnam’s meat and seafood exports. Vietnam is the world’s top cashew exporter and second-largest coffee exporter, with the West moving processing capabilities closer to the source.

- Renewable Energy and Infrastructure (10%) Japan and South Korea are investing in wind and solar energy. Germany’s KfW and the Asian Development Bank are supporting smart transportation and green industrial parks. Singapore signed agreements with Vietnam on transnational carbon trading and green zone development.

Doing Business in Vietnam: The Western Perspective

In U.S. supply chain circles, German manufacturing conferences, French brand forums, and even LinkedIn startup communities, you’ll find a recurring theme: growing interest in Vietnam. Why?

- Rising costs in China Ten years ago, everyone built production lines in China. Today, wages are rising, environmental pressure is increasing, and policy controls are tightening. “China +1” has become the norm—and Vietnam is the most mentioned “+1.”

- Geographic proximity to China Many parts made in Shenzhen or Dongguan are shipped to Vietnam for assembly and then exported to the U.S. and Europe. This improves logistics speed and cost.

- Aggressive investment promotion by the Vietnamese government Highways, ports, tax incentives, and industrial parks are being rapidly built. For many Europeans, Vietnam resembles China 20 years ago, but with a more approachable administrative system.

Why Do Business in Vietnam: International Business Outlook

Foreign firms typically evaluate three factors: cost-efficiency, risk control, and timely delivery. Vietnam performs well across all three.

Moreover, international companies find Vietnamese workers diligent, factories cooperative, and government non-intrusive—with added bonuses like EU or U.S. tariff exemptions. It’s seen as the ideal contract manufacturing base.

Still, few are naïve. Vietnam isn’t a substitute for China—it’s a complement. Large-scale integration and complex systems still rely on China. Vietnam excels in lightweight, modular, non-core production transfers.

Despite optimism, Western businesses often report these concerns:

- Infrastructure gaps: traffic and electricity instability, port congestion during peak seasons

- Talent shortage: difficulty finding skilled middle managers and workers

- Uneven policy execution: standards vary across local governments

- Language barriers: contracts and procedures often rely on English or interpreters

Vietnam is still a work in progress. Its infrastructure, governance, talent base, and policy consistency lag behind China, but this also reflects its dynamic potential.

Western businesses are driven by tax optimization, diversification, and global realignment. Chinese entrepreneurs, on the other hand, are drawn by new export hubs, relocation strategies, and opportunity mixes.

Conclusion:

Over the next decade, Vietnam may evolve beyond being a manufacturing substitute or capital arbitrage point. It could emerge as a redefined entryway into the new Southeast Asia.

Tips: In the next article, we will explore how to set up a company in Vietnam and choose the right operational model.