Contents

In China, the Ultimate Beneficial Owner (UBO) and Suspected Actual Controller are two related but distinct concepts, playing different roles within the ownership and control structure of companies. Understanding the differences between these concepts is crucial for compliance, due diligence, anti-money laundering (AML) measures, and more. This discussion focuses on enterprises within Mainland China.

What is Ultimate Beneficial Owner (UBO) in China

Definition: The Ultimate Beneficial Owner refers to natural persons who directly or indirectly own or control a significant percentage (usually more than 25%) of the company’s shares. The definition of UBO emphasizes ownership and/or control over the company’s shares.

Purpose: Identifying the UBO aims to disclose the natural persons hidden behind companies, trusts, or other legal entities in China, ensuring transparency of Chinese enterprises, and preventing money laundering and terrorist financing activities.

Official Recognition: In many jurisdictions, including Mainland China, businesses are required to register their UBO information and disclose it to regulatory authorities or banks conducting financial transactions under anti-money laundering laws and regulations. Thus, UBO information may be officially known to some extent, although the level of public disclosure and accessibility can vary by country and region.

Please read What is your China Business License?

What is Actual Controller

Definition: An Actual Controller refers to a natural person or legal person who, although may not directly own shares of a company, can significantly influence the company’s business decisions through other means, such as voting rights, contracts, or family relationships.

Purpose: Identifying the Actual Controller aims to reveal who actually controls the management and operations of the company, even if they may not own the company’s shares. This helps enhance the transparency of corporate governance and prevent financial fraud.

Official Recognition: Information on Actual Controllers is not as directly associated with share ownership as UBO information, and thus may not be as easily obtainable through official channels. Although some countries and regions have legal requirements for companies to disclose their Actual Controllers, the recording and public disclosure of this information may still be relatively low.

Related Terminology:

- Beneficial Owner: Refers to natural persons or legal entities that directly or indirectly enjoy the company’s benefits, hold voting rights, or have other forms of control over the company. This concept is closely related to Actual Controllers, typically used in the context of anti-money laundering and financial compliance.

- Ultimate Beneficial Owner (UBO): The Ultimate Beneficial Owner, the individual or entity at the top of the ownership structure who ultimately enjoys the company’s benefits and controls the company. This is key to revealing hidden property ownership and control chains.

- Shadow Director: An informal role, referring to individuals who, although not formally appointed as directors, their instructions or advice are followed by the board members.

- Controlling Interest: Refers to holding a sufficient share or interest in the company to influence company decisions and direction.

- Proxy Holder: An individual or entity authorized to exercise voting rights on behalf of shareholders.

Distinguishing China UBO and Actual Controller in Target Company

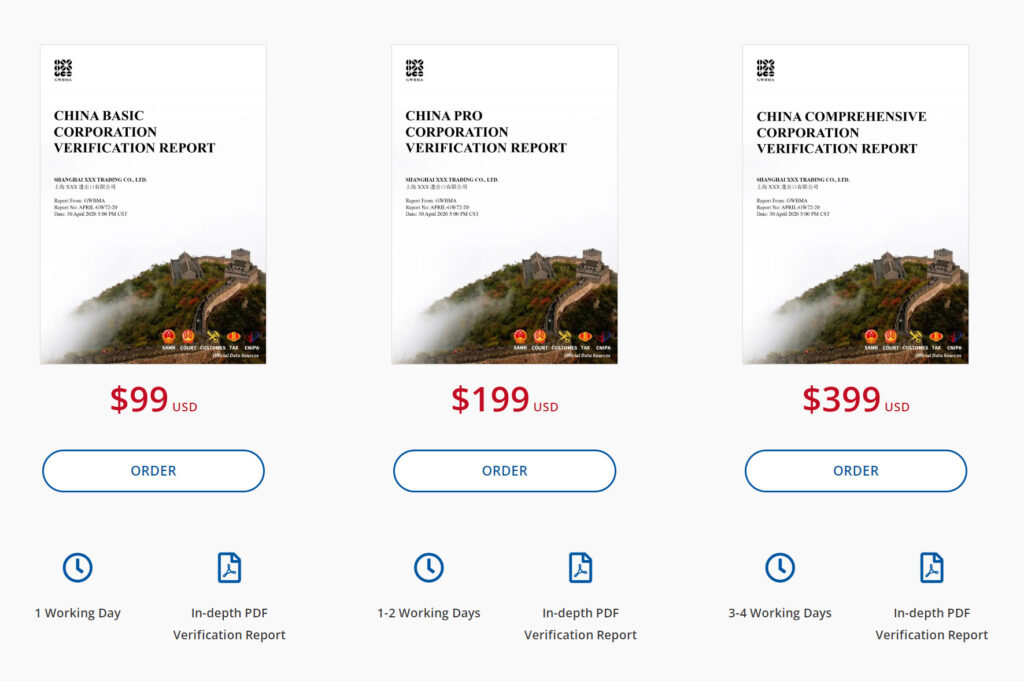

In our MANUAL COMPANY VERIFICATION REPORT and INSTANT AUTOMATED COMPANY REPORT, both Ultimate Beneficial Owners (UBO) and Actual Controllers are featured. However, particularly when choosing the Instant Automated Company Report, which is completed by machines in 3 minutes, it’s challenging to accurately inform customers about the Actual Controller. The only certainty is found in our Manual Verification Report, where the Suspected Actual Controller can be accurately identified. Additionally, it’s crucial to understand how to locate the USCC of the Chinese company being queried.

Our reports include a note: Tips: The data is searched through the official Chinese website online, and the content is for reference only.

Conclusion

In Mainland China, enterprises are required by relevant laws and regulations to identify and record information on their Ultimate Beneficial Owners and Actual Controllers. Given that UBO information is directly related to anti-money laundering regulations, it is relatively easier to obtain at the official level. However, information on Actual Controllers often relies more on the company’s own disclosure and thorough investigative work. Facing this challenge, GWBMA provides professional investigative services to help businesses and investors accurately identify these key individuals, thereby ensuring compliance and reducing potential business risks.

If you are looking to understand how to effectively identify Ultimate Beneficial Owners and Actual Controllers in Mainland China, or require professional support to meet your compliance needs, GWBMA‘s team, with its wealth of experience and expertise, is committed to offering you customized solutions. We ensure that your business operations are not only compliant with the latest legal regulations but also maintain a competitive edge in an increasingly complex business environment.